In India, it is necessary for a person to have PAN card and Aadhar card. If you also do not have a PAN card, then you can easily make it sitting at home. Till now you used to fill two page form to get PAN card and wait for months. Now the government has solved this problem of yours. Income Tax Department has introduced a new facility under which PAN card can be made in just 10 minutes with the help of Aadhar card.

To make a PAN card in some time, you have to follow two conditions.

- It is mandatory to link your mobile number with Aadhar card only then you can apply for PAN card.

- Your PAN card has never been applied before.

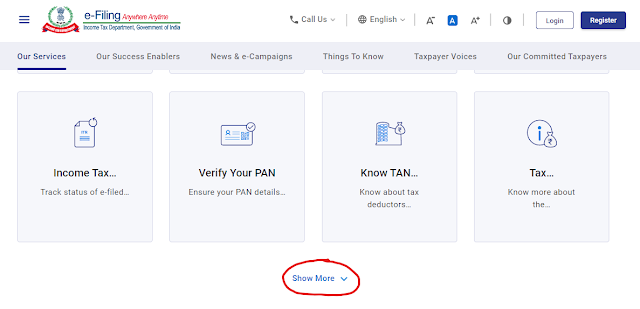

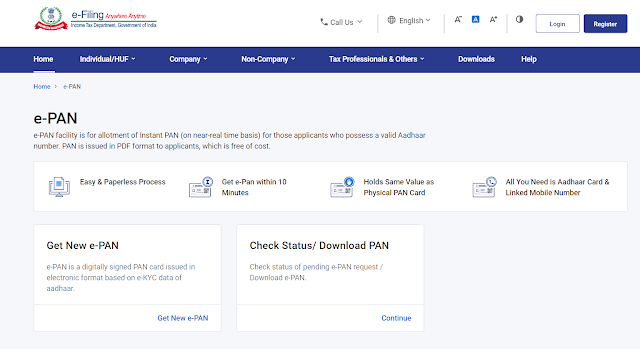

👉 First of all go to the website ” https://www.incometax.gov.in/ ” of Income Tax Department. After this, scroll the screen downwards. After that tap on “Show More” as you see in the photo.

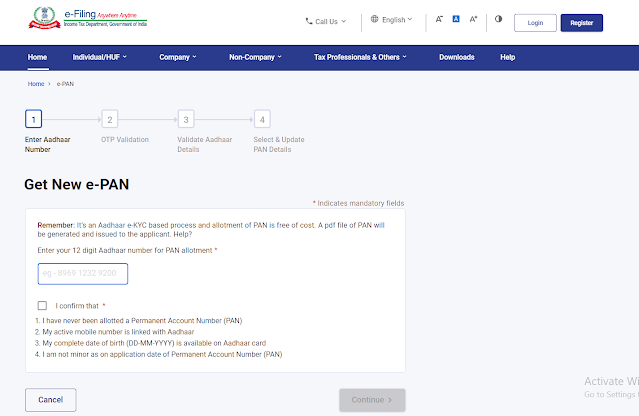

👉 After that enter your 12 digit Aadhaar number and tap on “I confirm that” and click on “Continue”.

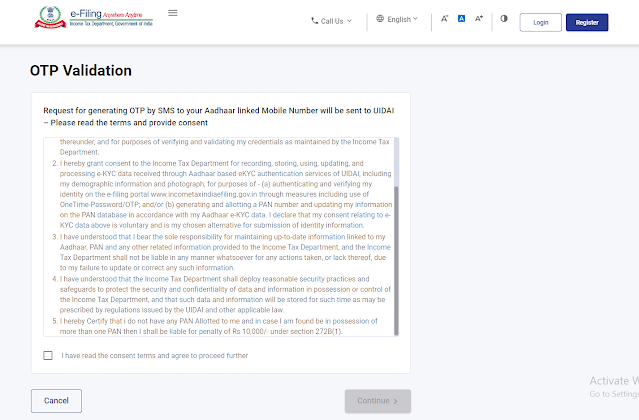

👉 After this the page of “OTP Validation” will appear in front of you as you can see in the photo. Tap on the box below and click on “Continue”.

👉 After this, “OTP” will come on the mobile number linked with your Aadhar card, after entering it, click on “Continue”.

After this you will see the information of your Aadhar card, check them thoroughly. All the information like name, photo, date of birth etc. in your Aadhar card will be printed in your PAN card. After checking all the information click on “Continue”.

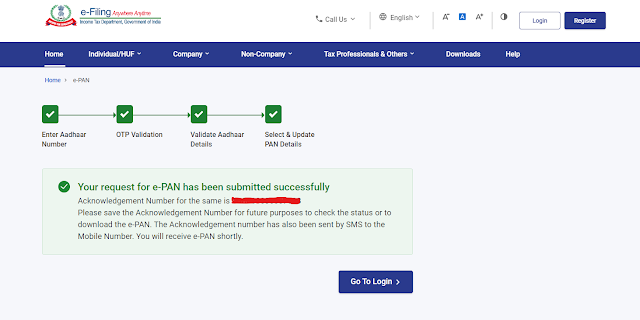

After this your “Request Submit” will be done, after that you will come back to the “Home” page.

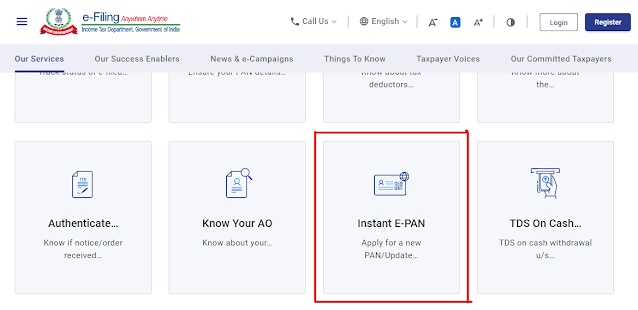

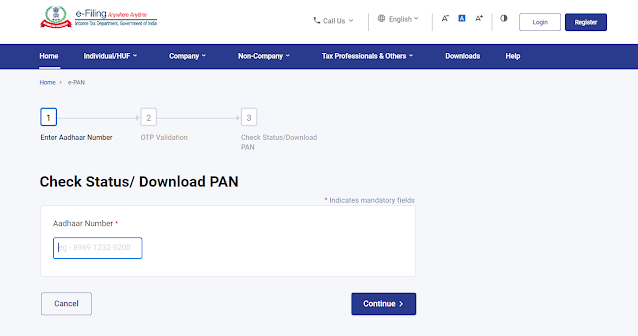

👉 After coming to the home page, you have to follow the earlier steps as you see in the photo below, you should come to this page after that click on “Check Status/Download PAN”.

👉 After that enter your Aadhaar number and click on “Continue”. After that “OTP” will come on your mobile number, enter it and “Continue”.

👉 After this the information entered by you will be checked. After checking everything, you will see two options “View E-PAN” and “Download E-PAN”, out of which you can view PAN card online by clicking on “View E-PAN”. And by clicking on “Download E-PAN” you will download the PAN Card.

After the PAN card is downloaded, it will ask you for the password. You have to enter your “Date of Birth” in the password. For example, if your ” Date of Birth ” is ” 05 June 2000 ” then your password will be ” 05062000 “.